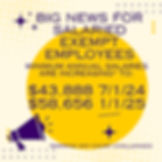

DOL Minimum Salary Changes - Effective July 1

- Gaunce Law

- Jun 24, 2024

- 3 min read

As you have likely heard, the United States Department of Labor (DOL) released a rule that will increase the minimum salary amount required to be paid to certain employees for these employees to be considered exempt from the Fair Labor Standards Act (FLSA) overtime pay requirements. On July 1, 2024, the minimum annual salary required for certain employees to be classified as exempt will increase to $43,888 ($844/week). This minimum salary will increase again on January 1, 2025 to $58,656 ($1,128/week).

Given legal challenges to this new rule, it is possible that these changes will be delayed and/or amended before going into effect. We think it is important to be prepared to make these changes on July 1 and stay tuned for any developments later this week.

Key Points

The rule covers FLSA exemptions for executive, administrative and professional employees. The final rule also applies to employees covered under the highly compensated employee exemption (details not addressed here).

To qualify for the exemptions from overtime for executive, administrative and professional employees, an employee generally must:

Be paid a salary (the "salary basis test");

Be paid at least a specified minimum weekly salary; and

Primarily perform executive, administrative or professional duties, as provided in the DOL's regulations (the "duties test").

If your exempt employees' salaries fall below the new threshold, you will generally either have to:

Raise their salaries to the new requirement; or

Reclassify the affected employees as non-exempt and pay them overtime whenever they work more than 40 hours in a workweek. Non-exempt employees can be salaried or hourly.

FAQ’s

Q: What employees are impacted by the changes made by the final rule?

A: The changes will generally impact any employee that is:

Classified as exempt under the executive, administrative or professional employee exemptions; and

Paid a salary that is below the new minimum threshold.

Q: Do the changes made by the final rule apply to small employers?

A: The changes apply to all employers covered by the FLSA and to all employees covered by the FLSA. Many small businesses are covered by the FLSA.

Q: Are there any exemption categories that are not impacted by this new rule?

A: Yes. Because teachers, outside sales employees and clergy are covered by exemptions that do not require compliance with the “salary basis test,” this change will not impact their compensation.

Q: If there is no impact to anyone as a result of these new salary requirements, do we have to notify employees of this change?

A: No.

Q: If an employee is classified as exempt from overtime but does NOT regularly work more than 40 hours, do I still raise their salary to $844.00/week?

A: If you want to keep the federal exemption from overtime, you must make sure their weekly salary is at least $844 beginning July 1, 2024 (and their primary duties continue to qualify for exemption). If you don’t pay them at least $844 per week in salary, you will have to reclassify them as non-exempt.

Q: If I have an exempt employee who works only 20 hours per week, would the minimum salary requirement for exemption be $422 per week?

A: No. For the overtime exemption, the employer is required to pay at least $844 per week in salary (from July 1, 2024 through December 31, 2024) even if the employee is part-time. There is no pro-rated minimum salary threshold for part-time employees.

Q: Can bonuses and/or commissions be used to satisfy part of the salary requirement?

A: Under the FLSA, employers continue to be permitted to use nondiscretionary bonuses, incentive payments and commissions to satisfy up to 10% of the minimum salary requirement ($84.40 per week in the second half of 2024) for the executive, administrative, and professional exemptions.

Q: What happens if the employee’s bonus or commission ends up being less than anticipated?

A: Employers may make one final catch-up payment no later than the next pay period after the end of the year, if the bonus, incentive payment or commission ended up being less than anticipated. For example, if an employer chooses this option, each pay period, the employer must pay their exempt executive, administrative or professional employee at least 90 percent of the salary level. Then, if at the end of year, the employee's paid-out salary plus the nondiscretionary bonuses and incentive payments (including commissions) doesn't equal at least the minimum required, the employer would have one pay period to make up for the shortfall.

Q: For the overtime exemption tests, can you count how much the employer pays toward health insurance or other benefits as part of the salary?

A: No.

If you need help navigating this change, we are here to support you. We have worked with many clients to find creative solutions to the challenges created by the new rule.

.png)